Everything in our economy costs money. There are tons of variables at hand as to how much we will pay for what. The purpose of this article is to quickly and easily paint a picture of how much things in our life cost and how to go about getting the best price and value we can for them. Please keep in mind these are median values, so they should be used as ballpark figures. I find it quite odd that people don’t discuss the price of the big things in life and I see examples every day where folks will be at a cash register arguing over their $1.00 CVS discount. Those same folks don’t always take into account the big stuff like mortgage interest rates, student loans, economic relocation, etc.

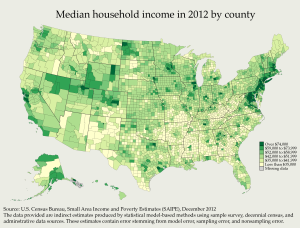

Salary: The median salary in the U.S. is ~$50,000. This equals ~$25/hour. To roughly convert a salary, simply divide the number in half and subtract the thousands. I.E. $50,000/2=$25/hour. Alternatively, to convert from an hourly wage to a yearly salary, simply double it and add 3 zeros. I.E. Bob the engineer makes $30 an hour, his yearly salary would be roughly $30×2=60 + ,000 = $60,000. There is a strong connection between education and higher median wages. For example a 25+ White Male working can expect to make the following salaries with the relevant degrees:

BA = $50,000

MA = $70,000

PhD = $80,000

Professional Degree (J.D., PharmD, MBA etc.) = $100,000

We need to keep in mind that median wages in America have been stagnant (when adjusting for inflation) for the last 15 years! It is a big reason why you may hear folks say things like “$200k is the new $100k”, or “3 million is the new million” and this is largely because there is a strong element of truth here. Our real buying power has gone down while some of the most important commodities like education and healthcare have skyrocketed. The middle class is basically shrinking due to globalization and technology. We don’t make as many physical goods as we used to in America AND this is coupled with the fact that technology has made it easier for folks to connect with other people all over the world where labor and services are cheaper. As the middle class shrinks, the poor tend to stay poor and the rich get filthy rich. However, and this is a HUGE however… With technology and globalization social classes are more easily navigated than ever before. A 20 year old nerd in his mom’s basement can code a computer game and become a millionaire/billionaire in a few years. A 15 year old can start an eCommerce store and earn more than his parents or teachers in short time. So as a whole, median salaries have been the same for nearly two decades, but it has never been easier to get stupidly rich for the same reason is it harder to get an average wage job: Technology+Globalization.

Education: Let’s start off with our discussion of eduction focusing around the BA, which is the most common factor in our ability to generate median income/revenue. Please keep in mind we are discussing undergraduate prices, which are generally significantly cheaper than graduate education. Public college costs ~$10,000/year for in state residents. If one is out of state they can expect to pay ~$20,000/year for education at a public college. Private college are by far the most expensive at ~$30,000/year. Oftentimes they will be even more expensive, for example the private college closest to me is Connecticut College which will run you $63,000/year as per their website. This is an asinine amount of money for a single year of college in case you aren’t aware ;).

The average person doesn’t graduate in just 4 years anymore, it is more like 5 years these days with some even claiming it is more like 6. I think it is fair to use the 5 year figure, so will will apply this multiplier. Thus for a single person to attend a public college in state is will cost ~$50,000, out of state it will be ~$100,000 and for a private school we can expect a median cost of ~$150,000. If our example student is attending a very expensive private school like Conn College they can expect to shell out ~$250,000! In a nutshell we can see no matter what school someone is attending, it will cost a significant chunk of change – ranging from a brand new 2015 BMW M3 to a new median house AND that new 2015 BMW M3!

We need to take into account that all of the above doesn’t even figure in interest rates. People end up paying thousands and sometimes hundreds of thousands of dollars additional in student loan interest. The standard interest rates are ~7% (6.8%) specifically from Sallie Mae several months ago. The effect is like trying to dig a hole while someone is throwning dirt in it. There is progress but it is very slow and depressing. Thus it is very wise for students to choose a major at a school where the ROI makes sense. Sam at Financial Samurai made an epic post regarding how to make six figures at any age one should reference. Basically the best ROI comes from STEM fields, I.E. science, technology, engineering and math education. Traditionally doctors, lawyers, eminent businessman and entrepreneurs have been known to earn a lot of money. These days we have an abundance of JD’s and MBA’s so one needs to be VERY careful in attending law/business school as it can be prohibitively expensive with job prospects dim unless someone is attending a top tier school like Sam mentions. It is about supply and demand and there are plenty of decent or sub par schools pumping out attorneys and businessmen. Top schools don’t just have prestige but they allow for connections, which are extremely important in a rough economy. Education doesn’t have to all be about college either. Self education, on-the-job training and eLearning are awesome ways to get skills and smart without the massive cost. A prime example of a learnable high value skill is computer programming. Most employers don’t put too much emphasis on formalized education if someone is a computer whiz.

By the way, the average student will now owe $30,000 in student debt when they finish undergrad in 2015.

Cars: Cars are something people spend too much money on because they want to look cool and/or they feel like they deserve an expensive car. In fact, it is one of the dumbest ways we can overspend, next to shelling out too much for a house. The average new vehicle cost $30,000 and it seems the only geographic region who can afford it in the whole country are those who work in D.C. with a wealth of high-paying government jobs. Meanwhile someone can purchase a high quality used Honda/Toyota/Ford for ~$10,000. Sam wrote a killer article about this called the 1/10th Rule for buying Cars. Basically don’t spend more than 10% of your income on a vehicle. This is smart because you have to have insurance on vehicles and pay for repairs, therefore they are a depreciating asset. That means these pesky things only lose value over time, unless you have some sort of sports car classic in mint condition that is in demand. These types of articles that Sam wrote can piss people off because they don’t have the money to follow the rule and therefore people start hollering and yelling “this is not realistic” “you aren’t considering the majority of people” yada yada yada. We could say making >$100k is ‘unrealistic’ or ‘just isn’t accurate for most people.’ Basically it is true if you tell yourself it is true. Sam has solid recommendations for transportation options that people could follow but some folks choose not to. Cars don’t make us money, so we don’t drop crazy money on them. Stay frugal and buy something reliable with cash. If you can’t do 10%, do 15% but don’t push it. Remember whatever we make in gross profits, Uncle Sam is going to bend us over for around 30-40%. Do you want to pay the man 30%-40% and 30% on your car or more? That would be unwise and probably piss you off down the line when you are paying car payments for years instead of stacking that cheddar :).

Housing: Firstly we should say that nobody truly ‘owns’ any house in this country. Does it sound silly? It pretty much is, we have this funky Tarif system left over from medieval times where we pay property taxes on everything we own. In Connecticut that means we pay ~$4k/year when we own a house. Here in Connecticut they also have property tax on our cars that sit on the property we already pay property taxes for… Ridiculous… but I digress. A median home in the U.S. that is sold costs ~$200,000 ($203,240) specifically. Now as we all know this number is highly variable in either direction due to what they refer to in real estate as location, location, location. People generally like to live by the water and close to cities. Houses that are closer to these things cost more, if the city makes good money, the housing will cost good money. By contrast the median rent price in the U.S. is ~$1,500 ($1,450) specifically. Now if one is looking to buy a house they are best off putting 20% down to avoid PMI or private mortgage insurance which tends to be a few hundred more per month folks need to pay. This PMI money is an insurance of sorts in case you default on your home loan. If one were to put the golden standard of 20% down on a median $200,000 house, it would come out to a $40,000 down payment. This means the remainder would have to be mortgaged. The median mortgage interest rate is 3.8% on a standard 30 year loan. On a 5/1 ARM it is currently 3.2%. If one were to purchase the $200k home with the 20% payment of $40k, then the $160k remainder would be mortgaged then for anywhere from 5-30 years. Let’s say we opt for the 30 year mortgage of $160k, @3.8% we would be paying ~$750 for 30 years. Notice how this amount is literally HALF of what it would cost to rent monthly. However if you take 30 years to pay it off you will be paying ~$270,000 total with interest… Now home ownership isn’t something to be taken lightly. Basically, things can break and one has to furnish, heat, cool, maintain etc. the house. In general if one is going to be staying around the area for 5 or more years, it makes a heck of a lot of sense to buy. When you own your house you can also rent out a room or two, thereby turning it into an income source.

In short there is another killer rule we have and that is the 2x rule from Dan Meyers. To put it simply don’t buy a house unless the total cost of the house is less than or equal to 2x your income AND you can put 20% down. I.E. If you make $100k, don’t spend more than $200k on a house and ensure to put at least $40k down. If you do this, you will be a lot more comfortable with the monthly payments and expenses that come with home ownership.

Kids: In 2013, the average cost of raising a child from birth to 18 is ~$250,000 (245,340) specifically. This is a large number and having a child is not something one should take lightly. Not only are there the emotional and time considerations but the cost is massive. This figure does not include college which as noted above can range from $50k-$250k. There is a reason why highly educated folks often wait longer to have children and have less kids. Those diapers, food, formula, clothes, cars, etc. aren’t cheap! I do not wish to delve into politics but it is a real drain on the economy when folks have children they can’t afford. I’ve seen bumper stickers that say “If you can’t feed em, don’t breed em.” I’d have to agree with this statement as it is not right to ask others to take care of your family because you opted to not use birth control and rampantly breed.

These critters cost money, probably close to half a million per kid accounting for future college tuition

Credit Cards: Credit cards are not inherently evil but carrying a balance most definitely is. A lot of cards have built in rewards, flight miles or gifts. They also add an extra layer of consumer protection for purchases and sometimes extended warranties on purchases. However, please use credit cards only if you have the cash to pay for your balance every month. If you don’t you will be paying around 16% interest on money you owe, which is a quick way to end up broke.

Healthcare: If your employer doesn’t offer health insurance, you can expect to pay around ~$300/month (before subsidies) for a young single male under an Obamacare plan. Insurance that costs 8% of ones gross salary is considered affordable. You will notice if you have a lot of student loans, the healthcare will be heavily subsidized to make it “affordable.” At any rate, consider how expensive healthcare and education were 20-30 years ago… Times have changes and Education and Healthcare are some of the most expensive things us americans have to pay for. Please note folks, if you are on an Obamacare plan and you are given subsidies – if you make more the following year you may have to pay back ALL of the subsidies – which will account for around $4,000 (Thanks Obama!)

So now that way know about the median cost of everything, perhaps we can all be a bit more wise/frugal about our spending habits. Personal finance does not have to be complicated, people just make it that way. At it’s essence all we need to do is ensure we are earning good money and make a good bit more than we spend. Most people carry an average of ~$16,000 Credit Card debt, ~$30,000 Student debt and average mortgage debts are around $160,000 if one has a mortgage. It is much better to be on the other side of debt than to be in debt. Being in debt is very stressful and debt can teach us a harsh lesson. The important thing is that we learn from it and make smart choices moving forward. Being informed about the median costs of big buys in America will make you a more educated consumer that will hopefully make wise choices.

Best of luck to you in 2015 and please tell us in the comments below if you have experienced any significant outliers in any of the medians listed above. This article is meant to be informative and generate discussion, so please be respectful of one another and understand everyone’s circumstances may vary.

Very nice post, Steve! I just scanned it. I’ll definitely read it again later!

Thanks Hans. This article was written to be a general overview about the big things in life. It boggles my mind how we don’t have these types of things discussed in high school. Financial wellness, nutrition, stress management. These things should all be courses in high school in America. If they were we would all be a lot better off. Heck maybe even the crisis of ’08 could have been avoided if people knew not to buy houses more than 2x their gross income. In those days people were getting subprime mortgages for 5-10x their gross… Disgusting predatory lending.